Our goal is to help you own your future.

Our industry experts offer advice on:

Guidance on Budgeting

Savings & Wealth Creation Strategies

Investment Planning

Superannuation Planning

Pre-retirement Planning

Retirement Planning

Aged Care Planning

Risk & Insurance Analysis

Estate Planning Considerations

Centrelink Planning

Super & Divorce Planning

Salary Packaging Advice

Business Succession Planning

Call us now on (02) 9488 0400 to book your free initial consultation or scroll down to find out more on how we can help you.

How We Can Help You

Select one of the following services to find out more. Prefer to talk to someone? Call us now on (02) 9488 0400 to find out how we can help you.

Who We Are

Expert financial advisors dedicated to helping you.

Financial success and security is all about establishing your goals (a financial plan) and developing an investment strategy that will help you achieve them.

At Investorplan, we aim to establish this plan and implement the investment strategy so that you can 'Own your Future'.

Investorplan enable clients to answer the following questions:

- How can I provide for a comfortable retirement?

- What investments should I have?

- How can I make the most of redundancy?

- Where should I invest?

- Should I borrow?

- How can I increase my wealth?

- Can I use Super to build wealth?

- Am I paying too much tax?

- How should I pass my wealth to my children?

- How can I insure to protect my assets?

Latest News

AI exuberance: Economic upside, stock market downside

The key findings of Vanguard’s economic and market outlook to be released in...

Becoming a member of an SMSF is easy, but there are other things that need to be considered

There are very few restrictions on who can become a member of an SMSF, but there are conditions with which...

Investment and economic outlook, November 2025

The latest forecasts for investment returns and region-by-region economic...

Move assets before death to avoid tax implications

Mitigating the impact of death benefit tax can be supported by ensuring the SMSF deed allows for the transfer...

ATO issues warning about super schemes

The ATO is warning SMSF trustees to be on the look out for superannuation and tax...

12 financial tips for the festive season and year ahead

Some investing steps to get you through the holiday season, the new year, and for the...

Birth date impacts bring-forward NCCs

The provisions allowing SMSF members to trigger the NCC bring-forward rules in a subsequent financial year are...

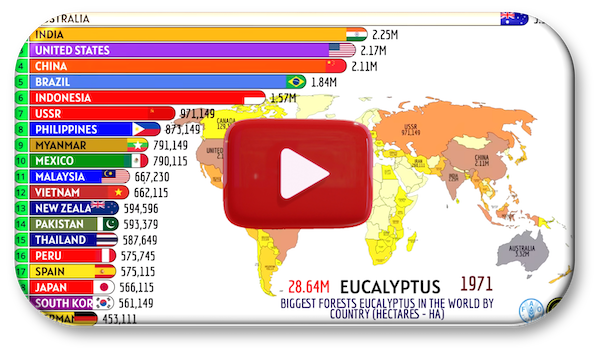

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

How to budget using the envelope method

Here's five simple steps to create a budget that doesn't involve tracking every...

Contact Us

Contact Details

- Phone:

(02) 9488 0400 - Fax:

(02) 9418 1588 - Email:

- Office Address:

Suite 2, Level 3, 828 Pacific Hwy, Gordon NSW 2072 - Postal Address:

PO Box 2, West Pymble NSW 2073 - Office Hours:

9AM to 5PM, Monday to Friday

After hours appointments may be available upon request.